Business as usual?

Corporate taxes are a mess; Facebook’s a great example of why.

Facebook’s going up against the IRS in a case that the WSJ deems could “shape the government’s ability to crack down on companies’ efforts to shift profits to low-tax countries.”

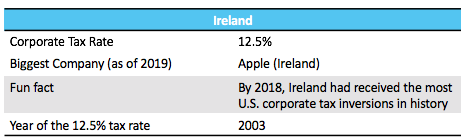

A bit of background: The IRS contends that Facebook should have been booking more profits in the U.S. than they were (and less in their Irish subsidiary). If you asked Facebook, they’d probably say they like Ireland (with its 12.5% tax rate) because of the talent there…but the tax rate is even more appealing we’d guess. In 2016, Facebook recorded global revenues of $27 billion, and Irish revenues were €13 billion (about half).

When U.S. companies repatriate their overseas profits, they’re on the hook for whatever the difference is between the international tax rate they had to pay and the U.S. tax rate (i.e. if the U.S. tax rate is 21% and the corporation paid taxes in Ireland, then they have to pay 8.5% to the U.S.) But they don’t have to repatriate their profits; that’s how companies end up with huge sums overseas, permanently reinvested.

It’s a race to the bottom when it comes to different taxes. Countries with struggling economies try to appeal to multinational corporations so that they set up international HQs, hire some folks and pay some minimal taxes there when really the multinationals are benefiting from infrastructure set up in other higher tax rate countries. (Barbados, we see you with your 5.5% tax rate.)

The Trump tax cuts recognized that countries were playing this competitive game and decided it would be best to lower the U.S. rate from 35% to 21%. But there’s another way: Gabriel Zucman and Emmanuel Saez argue (among other ideas in their latest book The Triumph of Injustice) that the U.S. needs to take the approach of being the collector of last resort. The idea: if companies want the benefits of having global headquarters in the United States, then they’ll be subject to being taxed at the U.S. tax rate (minus whatever they’ve already paid on profits booked abroad); regardless of if the money is deemed to be repatriated. As they put it: “The permission of tax havens is not required. All it would take is adding a paragraph in the United States tax code.”

The tax rules for Europe may be changing soon. According to Reuters, cross-border rules might be rewritten and the OECD is looking into it. While the U.S. is calling the idea of digital taxes in Europe discriminatory, Zuckerberg’s said he thinks it’s understandable that European countries want an overhaul.

What now?

Check out the companies that lobby most on tax issues: Comcast, Microsoft, Altria Group (formerly Philip Morris), and NextEra Energy.

On the topic of taxes … read the 2019 proposal of some Republicans to get rid of the income tax and replace it with a sales tax. Yikes. Right, because you should only be taxed on consumption, which would hit poorer people much more than the wealthy…?

Get the stats on what companies are paying post-tax cut. “Just five companies — Bank of America, J.P. Morgan Chase, Wells Fargo, Amazon, and Verizon — collectively enjoyed more than $16 billion in tax breaks in 2018.”

What else?

BP Wants to Become Carbon Neutral by 2050, but Doesn’t Say How

The Shock of Unemployment May Push Men Into Jobs Traditionally Held by Women, Study Shows

That’s all for now, folks! We are thrilled that you followed our pilot test, and thank you in advance for your invaluable feedback. We’d appreciate it if you would fill out our FEEDBACK SURVEY by March 1, 2020 (we’ll send a few more gentle nudges before the deadline).