Visible Hands: Can an old oil company learn new tricks? 🛢️

Although the oil majors only account for 15% of oil and gas production (massive state-owned producers like Saudi Aramco are 50%), these companies have on outsized influence on industry practices.

We are excited to have Sophie Purdom of Climate Tech VC as our guest contributor today. She and her team started a weekly newsletter about science and innovation at the nexus of business and climate (check out their latest issue here).

Earlier this year, Total - the massive French oil and gas supermajor - proclaimed to the world that it has seen the (green) light!

Total announced that it would adopt new climate ambitions to reach net-zero emissions by 2050, following in the footsteps of announcements from its frenemies, Shell and BP, this past quarter. Net-zero, or carbon neutral, means “achieving an overall balance between emissions produced and emissions taken out of the atmosphere,” which often means companies, such as Lyft, will purchase carbon offsets from land use projects or non-profit organizations.

Total committed to 60% decarbonization of their worldwide energy products by 2050 (that includes “Scopes 1, 2, 3” emissions -- meaning direct and indirect emissions). Given that indirect emissions (think: tailpipe emissions from cars fueled with Total’s oil) are particularly difficult to address, their commitment sounds pretty serious!

We were particularly struck by Total’s promise to meet governments’ decarbonization policies and regulations across all of the regions that it operates in. In practice, this essentially commits its European operations to meet 100% net zero by 2050.

What’s the bigger story?

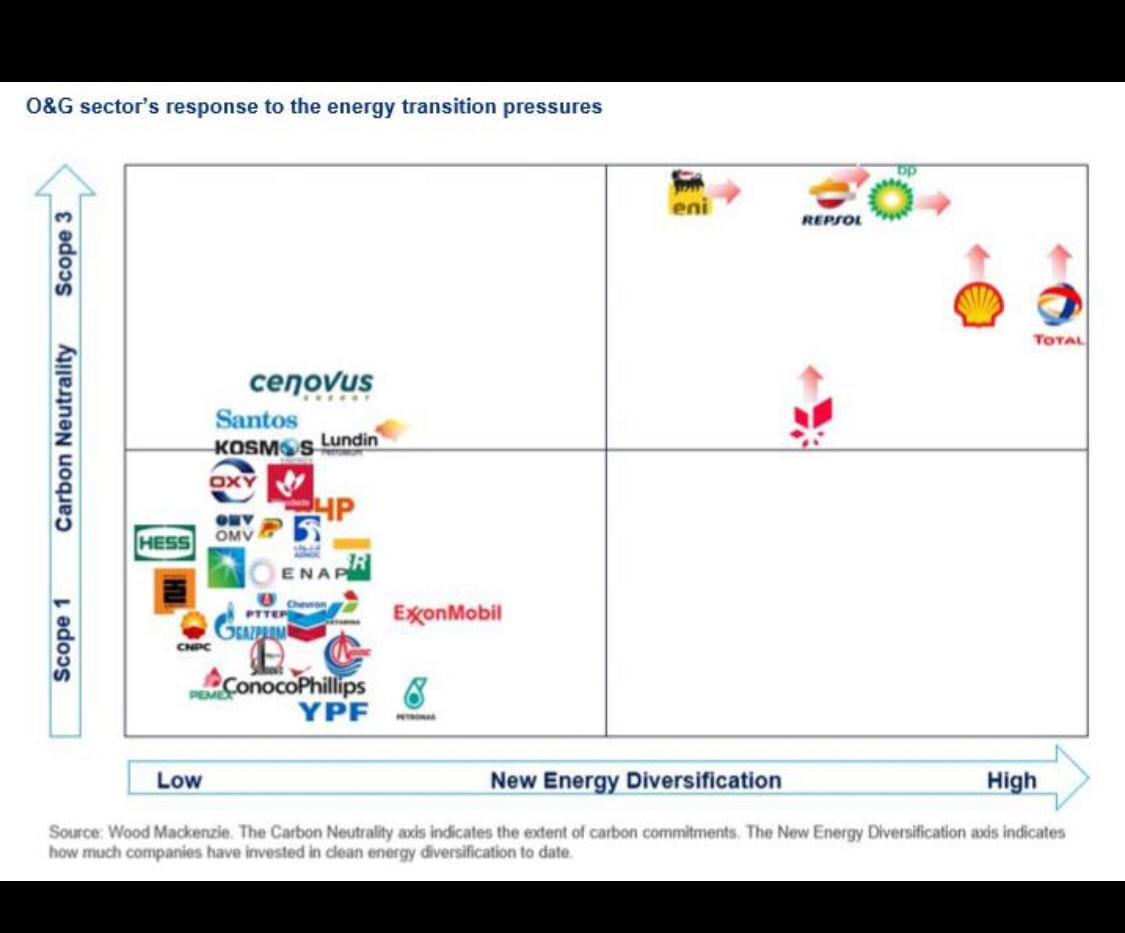

Leave it to a good old 2 by 2 to show a split from the pack. European oil & gas majors (aka the big players) are diversifying their energy portfolio and making public carbon neutrality pledges, while their American counterparts lag.

Investors, scientists, and the public have repeatedly voiced their concern that oil & gas companies can no longer operate under “business as usual.” As their social license to operate wanes, these companies are in the spotlight to demonstrate how they are rethinking their business model in light of climate change.

Although the oil majors only account for 15% of oil and gas production (massive state-owned producers like Saudi Aramco are 50%), these companies have an outsized influence on industry practices and direction. All eyes will be watching how companies such as Total, Shell, and BP outline the specific measures and technologies to meet their net zero ambitions. They’re harbingers of the remainder of the market.

As an investor:

While net zero pledges seem to be the growing fad in the energy business, the major question remains: how exactly will an oil and gas company based on carbon-intensive fossil fuels pivot to carbon neutrality? So far, investments in low-carbon businesses only represent <1% of oil and gas companies capital expenditure. Total pledged to devote 25% of capital expenditures to low carbon energy by 2030, though figures for other majors are lower. As an investor, you must decide between betting on existing 100% renewable energy companies, the likes of NextEra, Brookfield Renewable Partners, TerraForm, or believing in the legacy energy producers’ ability to transform?

As an employee:

If you’re an employee at a legacy emitter, you’re actually in a meaningful place to turn the big ship a few degrees and have a large impact. Today, 15% of global energy-related GHG emissions come from simply moving oil and gas from the ground to consumers. There’s clearly an innovation gap. Oil majors will have to invest heavily in technologies such as hydrogen, biofuels, and carbon capture which today do not exist at the scale needed to achieve their targets.

As a consumer:

Renewables are the only energy category projected to grow during 2020. As energy and transportation markets shift towards electricity, these carbon neutrality commitments may have payoff beyond public favor, and will sustain a more diverse and resilient energy portfolio. As a consumer, opt for electricity over fuels where you can, in your future travel particularly.

If you are interested in calculating your carbon footprint and purchasing carbon offsets of your own, make sure that you are supporting reputable groups certified by Gold Standard and Green-e.

As a citizen:

The single most influential impact on limiting climate change is a meaningful global price on carbon. Economists, scientists, and markets across the world agree. Check out the Climate Leadership Council for their bipartisan solution. As a citizen, lobby all levels of public officials to make it known that you demand a meaningful price on carbon. Only then will existing oil & gas companies truly transform into carbon neutral energy companies.

Thank you again to Sophie for offering her insights in this feature.

We sent out a newsletter yesterday on racial justice and Black Lives Matter, and we have continued to update our post on Medium. We encourage you to check out those resources and be an active changemaker. Be like Ben and Jerry’s (Unilever) or at least the American Airlines CEO, not Facebook or L’Oreal.

Next Wave of U.S. Job Cuts Targets Millions of Higher-Paid Workers: “[Employees are] experiencing what one research paper found to be employers pulling back postings for high-skilled workers more than others. That leaves recently laid-off Americans in white-collar industries facing dislocation of income, fewer open positions and likely lower pay when they do find a job.”

New Bill Would Mandate Research on Relaxed Telehealth Regulations after Coronavirus: “[Rep. Robin Kelly] said she introduced the bill after hearing stories from providers from her district and around the country about the availability of telehealth effect on patient attendance. ‘We wanted to study how we can keep this going. Is this the new norm?’”

Pilgrims Pride CEO Charged by U.S. in Price-Fixing Conspiracy: “Executives who cheat American consumers, restauranteurs, and grocers, and compromise the integrity of our food supply, will be held responsible for their actions…”

Pfizer’s Zoloft Falls Into Shortage as Virus Anxiety Strains Supplies: “Isolation and anxiety triggered by the coronavirus have heightened demand for mental-health services. Zoloft prescriptions climbed 12% year-over-year to 4.9 million in March, the most ever in the U.S.”

Stay connected with us through Instagram, Medium, Twitter, and, of course, email (visiblehandsmedia@gmail.com)! Please invite any friends, roommates, coworkers, armchair activists, and oil tycoons to join the movement. See you next Thursday!