Visible Hands: The Tale of Two Pandemics 🎭

Guest writer, Ronnie Westmoreland, explores how working-class Americans are running out of lifelines while the wealth gap widens.

We are excited to have recent Chicago Booth graduate Ronnie Westmoreland as our guest contributor today. He has a background in credit through his experiences in corporate banking and private debt and will be joining Bain & Company as a consultant later this year.

While the fallout from the virus deepens due to a surge in cases across the country, we continue to see the tale of two stories between working class citizens and America’s wealthiest. The country’s wealth gap is being exacerbated as the rich see record high net worths while the working-class American run out of lifelines.

Many Americans are facing a financial cliff at the end of July with limited helpful options. Banks are tightening their lending standards, the additional $600 federal unemployment insurance benefit is scheduled to end July 31, and eviction moratoriums are ending in many states. The disappearance of these would-be lifelines to the average American could force many who have been furloughed or laid off to make the difficult decision between groceries and their next housing payment.

In response to COVID-19, banks have begun to pull back on consumer lending across three segments: credit cards, mortgages, and auto loans. For example, in the first quarter Wells Fargo cut the maximum amount that homeowners can borrow against the value of their homes as well as applying stricter valuations to applicants’ homes. Furthermore, as many Americans look to take advantage of historically low interest rates set by the Fed, banks have cited a lack of visibility in their customers’ financial situations as to why there’s a decline in approvals of consumer loans.

Source: U.S. Bureau of Labor Statistics

With approximately 17 million workers continuously claiming unemployment insurance and an additional 14 million self-employed/gig workers claiming the newly created Pandemic Unemployment Insurance, consumers have scrambled to shore up their nest eggs while the amount of credit available is shrinking. This credit decline has been the most dramatic in credit cards which, unlike mortgages and auto loans, are unsecured, making them a riskier type of consumer lending. The financial strain created from the virus developed so quickly that many applicants went from safe borrowers to risky borrowers overnight, causing banks to slash credit limits of existing customers and require higher credit scores for new applicants. Many cash-starved Americans face an uphill battle as there are no set plans for additional government aid, eviction moratoriums are winding down across many states, and banks look to protect themselves in this current economic environment.

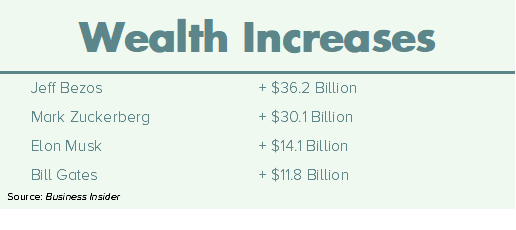

It has been said that the current pandemic is expected to expand the wealth gap in America. As the “average” American is facing a financial cliff, the richest Americans are seeing their fortunes soar to record heights. America’s 630 billionaires have seen their wealth grow by ~$583 billion during the pandemic (that’s almost 3 times the entire market cap of Disney today).

Adding fuel to the fire is the fact that the country’s wealthiest have become masters in the art of tax avoidance. A recent study from UC Berkeley found that in 2018, for the first time in U.S. history, billionaires paid a lower effective tax rate than working class citizens (23% and 24.2%, respectively). As taxpayer money continues to fund relief efforts, a group of the world’s wealthiest (including Abigail Disney) have signed an open letter demanding a tax increase on all wealthy individuals like themselves to increase relief efforts without overburdening the working class or government deficit. The stark contrast between the pandemic’s effect on the working class and the wealthy needs to be addressed in order to fix the damage to consumer confidence and the economy.

As a consumer:

Learn more about the companies that are known for giving back to the community and working with underserved and impoverished areas, such as Chewy which donated $1 million dollars in pet food and supplies to pet parents in underserved communities and impoverished rural areas in April. Other brands have committed to support those in need during the pandemic like Thrive Market which is currently matching every paid membership with a free membership for a low income family or first responder.

As an employee:

Many employers offer an employee match to donations (up to a maximum amount) made to nonprofit organizations and there may be opportunities to push employers to contribute more to their local communities. The Charity Navigator is a helpful tool to find nonprofit organizations in your local community that are focused on helping underserved areas and providing relief to those impacted by COVID-19.

Platforms like Benevity and Blackbaud can help kickstart an employee-centric corporate giving and volunteerism program.

As an investor:

Align your values with your investments. Research shows that a social and environmental focus on investment management can also boost financial returns through establishing credibility with stakeholders and enhancing branding.

Although there is definitely greenwashing in corporate social responsibility reports, consider the corporate values and philanthropic initiatives at companies you’re investing in. For example, Google has published information about their community grants and recently announced a collaboration with The Conscious Kid to promote racial equity in classrooms. (Though Google is by no means a star citizen, as evidenced by the strike earlier this week.)

As a citizen:

The International Monetary Fund has a database that tracks each country’s policy response to the pandemic. Stay informed on the latest federal policies the United States has enacted.

Work with local activists and community leaders to lobby for the extension of relief programs. All members of Congress can be reached by calling the Capitol switchboard at 202-224-3121 and asking for your Senator or Representative by name. You can also access your Representative's or Senator's direct contact information to call for further relief in your communities.

Thank you again to Ronnie for offering his insights in this newsletter.

📚 Book club meeting alert! We’re reading The Fifth Risk by Michael Lewis. Join us THIS Sunday, July 26 @ 2 PM ET / 11 AM PT (Zoom link here and here’s the calendar invite). Excited to discuss your thoughts on the book and the role of government broadly. And please feel free to come even if you haven’t had a chance to finish (or read a page of the book).

In Electric Car Market, It’s Tesla and a Jumbled Field of Also-Rans: “Of course, Tesla’s success is not guaranteed. It hasn’t reported an annual profit since its founding in 2003. The company has struggled to match the quality levels of traditional automakers, and it is spending heavily on Model Y production and developing a pickup truck, a semi truck and other vehicles.”

What Coronavirus Job Losses Reveal About Racism in America: “The Black unemployment rate is always ridiculously high, but we don’t treat it like a crisis,” said Jessica Fulton, vice president of the Joint Center for Political and Economic Studies.

How Ben & Jerry’s Perfected the Delicate Recipe for Corporate Activism: “Ben & Jerry’s activism didn’t slow through a mid-1980s initial public offering or its acquisition for $326 million in 2000 by Unilever.”

Slack Files EU Antitrust Complaint Against Microsoft: “Slack says it has been discussing its gripes about Microsoft with regulators in the U.S. and elsewhere for some time, but that Microsoft’s conduct has accelerated in recent months. Its decision to file a complaint first in the EU rather than the U.S., where both it and Microsoft are based, stems in part from the EU’s aggressive pursuit of antitrust cases against U.S. companies.”

A federal eviction moratorium ends this week, putting 12 million tenants at risk: “The problems facing renters will only get worse once enhanced unemployment benefits run out and people exhaust their savings, said Dworkin, a former Treasury Department senior adviser on housing finance during the Obama and Trump administrations. Once any moratorium ends, tenants could be asked to come up with months of unpaid rent they can’t afford, he said.”

Apple promises to become fully carbon-neutral by 2030: “The majority of the progress, Apple says in its 2020 environmental progress report, will be made by cutting its carbon emissions directly. But the last 25% will come from “carbon removal solutions” such as forest planting and mangrove swamp restoration.”

⭐Shout out to Deanna, Madhura, Ariana, and Paisia (our amazing Upkey team) for helping us build our marketing and social media presence over the last two weeks! Stay connected with us throughMedium, Instagram,Twitter, Facebook, LinkedIn, and, of course, email (visiblehandsmedia@gmail.com)!

Please invite any friends, roommates, coworkers, armchair activists, and billionaires to join the movement. See you next Thursday!